DANDONG, China — The textile factories producing “made in China” goods from compounds just across the Yalu River from North Korea offer a glimpse into a hidden world that is helping North Korea’s economy to thrive.

Operated by North Koreans, the factories produce clothes and other goods that are exported under foreign-company labels, making it impossible to tell that they have been made with North Korean hands and have contributed to North Korean profits.

The thriving operations belie the perception in Washington that U.S. and international sanctions are working to strangle North Korea’s ability to make money. While an overwhelming majority of North Koreans live in poverty, the country’s output has been steadily increasing, and an estimate by South Korea’s

Hyundai Research Institute forecasts that the North’s economy will grow this year by a whopping 7 percent.

A lot of that growth comes through Dandong, a hive of North Korean and Chinese managers and traders, with middlemen helping them all cover their tracks. One local Chinese businessman estimates that one-quarter of this city’s population of 800,000 is involved in doing business with North Korea in some way.

In one factory on a recent day, dozens of North Korean women sat under fluorescent strip lights sewing seams and pressing pockets on pants, some of which were destined for the United States.

The view of Sinuiju, the North Korean city across the river from Dandong. There’s plenty of trade across the border with China. (Anna Fifield/The Washington Post)

The view of Sinuiju, the North Korean city across the river from Dandong. There’s plenty of trade across the border with China. (Anna Fifield/The Washington Post)

“They are here to make money for the country,” a North Korean factory manager said of the workers.

This scene is repeated in dozens, perhaps hundreds, of labor compounds all along the border, which in effect is little more than a line on the map. The extensive range of commercial activity suggests that it would be wrong to think that China’s leadership is now so annoyed with Kim Jong Un, who took control of North Korea at the end of 2011 after the death of his father, that it is tightening the economic screws on the young leader next door.

This is a very sensitive part of China — during a week of reporting along the North Korean border, Washington Post reporters were monitored by police — and doing business with North Korea is a very sensitive subject. The textile-factory manager would allow himself to be identified only as Mr. Kim; he and other North Korean businessmen who agreed to speak about their operations otherwise did so on the condition of anonymity for fear of jeopardizing their livelihoods.

North Korea’s economy is still a basket case, barely more than one-fiftieth the size of South Korea’s. But in talking about the changes underway, the businessmen described a North Korean economy that is increasingly run according to market principles, where people want to be in business, not the bureaucracy, and where money talks.

Mr. Kim, the textile manager, said he has no qualms about making pants to be worn by men going to work in “imperialist aggressor” countries such as the United States, South Korea or Japan — the three most hated enemies of his country.

He was only interested, he said, in maximizing profits for Pyongyang, wherever they come from.

“It doesn’t matter whether they’re an enemy country or not,” Kim said.

Fundamentals of capitalism

In the clothing factory, the women work 13 hours a day, 28 or 29 days a month, and are paid $300 each a month — one-third of which they keep. The rest goes back to the government in Pyongyang.

“Even though I want to pay them more, I have to send a certain amount home to my country, so this is all I can give them,” Kim said in his office at the factory. On his desk, an open laptop revealed that visitors had interrupted his game of solitaire.

The women work on the third floor, wearing their coats inside to guard against the cold, and live on the second floor in shared, dormitory-style rooms decorated with a banner declaring, “Let’s realize the revolutionary ideas of Kim Il Sung and Kim Jong Il” alongside portraits of the two former leaders, grandfather and father, respectively, of Kim Jong Un. Signs on the doors read, “Call each other comrade.”

North Korea is thought to have at least 50,000 workers outside the country earning money for the regime, and 13,000 of them work in Dandong.

This neon explosion of a city contrasts starkly with the North Korean city of Sinuiju, on the opposite bank of the river, where there is only a smattering of light at night.

But there are signs of large-scale construction on the North Korean side: a half-completed apartment tower with a crane on the top and other new buildings underway. Although the traffic crossing the bridge between the two cities is far from jammed, it is constant. A steady flow of vans and container trucks, and the occasional black sedan with tinted windows, crossed in both directions over the course of a week.

Passenger and freight trains ran regularly, carrying cargo such as steel bars for construction and unrefined gold dirt.

Consumer goods go in the other direction. The most popular items to sell in North Korea these days are TV sets hooked up to solar panels — preferably with USB ports for watching smuggled dramas.

Here, North Koreans are coming to grips with the fundamentals of capitalism, even if they still won’t use the term.

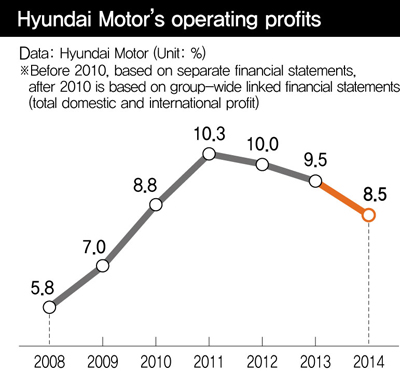

Over dinner one night at a Chinese restaurant, another North Korean factory manager happily chatted about his corporate role models. Chief among them: the titans of South Korean conglomerates such as Samsung and Hyundai who propelled that country’s rapid economic transformation.

What had he learned from those tycoons in the South?

“Perseverance, the need to diversify,” said the businessman, who manages a factory that produces goods related to the construction industry and was sporting a Tissot watch. “We’re living in a world where new things keep appearing. Who would have thought Nokia would have collapsed? Their mistake was sticking with the same product.”

He has absorbed some of these lessons from the outside world, describing steps he has taken to increase productivity at his factory — mainly by creating better working conditions so his employees want to work more — and boost his profits.

This is emblematic of the tentative economic experimentation taking place since Kim Jong Un became leader.

Reports from inside North Korea suggest that even state-run companies are increasingly operated according to market principles, with managers empowered to hire and fire workers — previously unimaginable in the communist nation — and conduct businesses the way they see best.

Obstacles, opportunities

There are frustrations here. The biggest one — literally — has to be the four-lane, $350 million New Yalu River Bridge, a huge steel structure that traverses the river from a glitzy urban development, Dandong New District.

The whole development project is now on ice, partly because of the

demise of Jang Song Thaek, the businessman and uncle of Kim Jong Un who was executed at the end of 2013, partly because of his “decadent capitalist lifestyle.” Since then, Jang’s colleagues have been recalled to Pyongyang or have disappeared — sometimes with millions of dollars in Chinese money, according to businessmen here.

Beijing is clearly none too happy about this, and smaller Chinese operators also have complaints about dealing with North Korea.

One Korean Chinese businessman named Ri who exports raw materials from North Korea said there are lots of “fraudsters” there.

“Sometimes the North Korean takes the money, but then you can’t find the person,” he said. “As the middleman, I have to take responsibility for that. There are some people here who’ve committed suicide because they’ve lost everything.”

A well-to-do Chinese couple who run an exporting business in Dandong — she was carrying a Chanel bag, he had an Armani sweater — could barely conceal their distaste for the state across the river. They used to export kitchen goods to North Korea but have stopped, saying it was too hard to make money there.

Asked if they had seen signs that North Korea is opening up its economy, the woman said, “Oh, you’re so naive!”

“I haven’t seen any signs of that,” her husband chimed in. “We built this whole new bridge, but North Korea hasn’t built anything.”

But while the political chill between North Korea and China might have had an impact on state-level economic cooperation, and those who played in the big leagues with Jang might have been scared away, there are still plenty of small businessmen looking for — and finding — ways to make money.

“These guys are out there to make a buck — they’re not the World Food Program — and as long as these opportunities exist, private, profit-seeking, market-conforming trade and investment will continue,” said Marcus Noland, an expert on the North Korean economy at the Peterson Institute for International Economics in Washington.

Take Zhang, a Korean Chinese merchant who runs one of the 30 or so Chinese businesses in Dandong that ship fabric to North Korea to be turned into clothes there for European companies. Zhang said that he employs a few dozen people on the Chinese side of the border but that his workforce in North Korea fluctuates between 3,000 and 10,000 people, depending on how many orders he has.

North Koreans are particularly good at painstaking, manual work such as lace-making and hand-stitched beadwork. He pulls out his smartphone and shows a photo of a blond woman wearing an intricately embroidered pink and white dress, a product of North Korean labor.

Zhang, who speaks Korean and Chinese, does not even need his passport to enter North Korea. He has a permit that allows him to travel back and forth freely. He talked about how he’s developed good relations with his business partners there.

“Over the past few years, I’ve built trust with the North Koreans,” he said. “Every year around the birthdays of the leaders, I go there in person and take fruit and flower baskets. I pay my respects to the leaders, and I’m sure my clients report this back to the authorities.”

Moving money

For North Koreans who make money on the Chinese side of the border, one question is how to get it back to Pyongyang.

Since the start of the Korean War in 1950, when it included North Korea in the Trading With the Enemy Act, the United States has sought to restrict North Korea’s ability to bank and trade.

This has tightened markedly over the past decade, with the United States imposing rounds of sanctions designed to curtail North Korea’s ability to procure materials for its nuclear weapons program by shutting the country out of the international financial system. The latest measures were imposed in January as punishment for the

hacking of Sony Pictures Entertainment.

The restrictions hurt at first. But North Korea has wised up. It uses small banks in China or Russia to transfer money — several banks in Dandong said it was possible to wire money to Pyongyang, for a hefty commission — or simply reverts to old-fashioned suitcases full of cash, which are much harder to stop with sanctions.

There is a sense in Dandong that sanctions are an issue for Washington and Beijing but that they don’t apply here on the border.

“I’m just a local businessman,” Zhang said, adding that sanctions “apply to big, international companies, not to private individuals like us,” clearly considering his business with North Korea domestic. “Anyway, we find ways to get around them.”

Ri, the Korean Chinese trader, said that his business partners always want cash.

“So they come out or I go into North Korea to settle the bills,” he said in his office in Dandong, running wooden beads through his fingers. “They like to be paid in U.S. dollars, euros, Japanese yen.” (North Koreans returning to Pyongyang apparently like to carry American dollars, for the cachet.)

Everyone interviewed said that it is entirely possible to send cash to North Korea — people usually just carry it in bags over the bridge — and that while there might technically be limits on how much a person can carry, in practice there are no checks, or at least no checks that cannot be overcome by greasing a few palms.

But the regime doesn’t always want cash. The North Korean businessmen who talked to The Post said they buy goods according to orders from Pyongyang and ship those back instead. Recently, they have been asked to send back solar panels and generators to help deal with North Korea’s chronic electricity shortage.

‘Like lips and teeth’

Relations between China and North Korea are complicated, but one thing is clear: Politics and economics are not entirely intertwined.

“There is a lot of jumping to conclusions in Washington and discussion about China showing a strong hand to North Korea,” said John Park, a North Korea sanctions expert at MIT. “I don’t see the evidence for that.”

Although trade appears to have dipped recently, that is the result of sharp declines in prices of commodities such as coal and iron ore — two of North Korea’s biggest exports to China — rather than some kind of punishment for Kim’s lack of deference to Xi Jinping, the Chinese president.

The young North Korean leader has not made the traditional pilgrimage to visit the state’s patron.

But pragmatic China, Park said, does not want North Korea becoming unstable and risk unsettling this precarious northeastern part of China.

“As you must have watched lots of historic soap operas in South Korea, you will know that China and North Korea are like lips and teeth,” said the North Korean factory manager over dinner, repeating an old saying about the neighbors. “Economically, nothing has changed.”

Yoonjung Seo and Hallie Gu contributed to this report.

Read more: