Export, consumption, investment all weaken on eurozone debt woes;

2011 GDP down at 3.6 percent

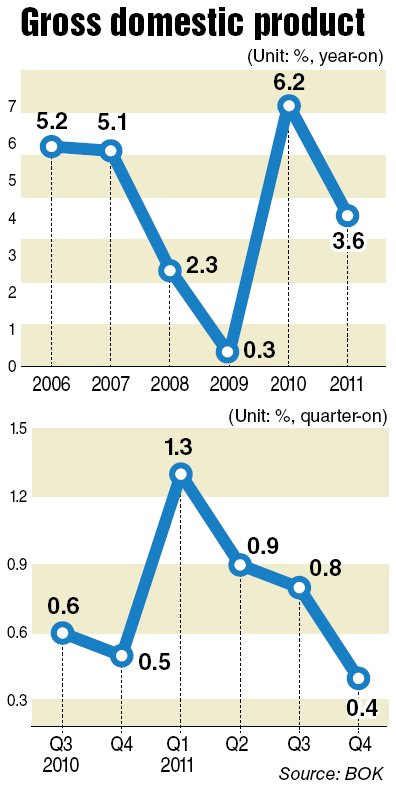

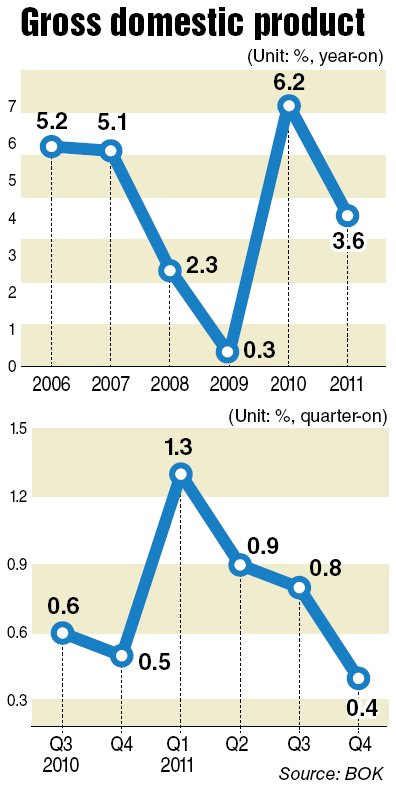

Korea’s economic growth slowed further at the end of 2011 amid deepening concerns about the impact of the eurozone fiscal crisis on exports.

The country’s gross domestic product rose 0.4 percent in the October-December period from the previous quarter, marking the lowest gain in two years, the Bank of Korea’s data showed Thursday.

GDP growth, the broadest measure of economic performance, steadily lost steam last year from 1.3 percent in the first quarter to 0.9 percent in the second and 0.8 percent in the third, according to the bank’s advance estimate.

The economy grew 3.4 percent in the final quarter from the same period a year earlier, slowing down from 3.5 percent year-on-year growth in the previous quarter. For all of 2011, the GDP expanded 3.6 percent, down from 6.2 percent growth in 2010 and slightly lower than the BOK’s earlier projection of 3.8 percent.

All three key indicators ― exports, consumption and investment ― were all in negative territory in the final quarter.

“The eurozone sovereign debt crisis seems to have hit Korea’s facility investment and consumption with a bigger impact that previously thought,” said Kim Young-bae, director general of the BOK’s economic statistics division, at a news briefing after the advance figures were released.

“The key in the first quarter of this year is how much the country can shield itself from the eurozone’s influence,” Kim said.

A closer look at the GDP data reveals an unsettling trend for Asia’s fourth-largest economy. Exports, which account for 50 percent of the country’s GDP, dropped 1.5 percent in the fourth quarter, swinging into the red for the first time in two years, hurt by deteriorating demand from abroad.

Imports fell at a faster rate of 3.1 percent from the previous quarter, as Korean companies cut import orders for capital goods in the face of greater external uncertainties.

Private consumption dropped 0.4 percent and facility investment plunged 5.2 percent during the cited period.

“Private consumption is expected to remain at a weaker level this year, as consumers struggle with higher housing costs, less disposable income due to rising oil prices and the sluggish financial market,” said Park Jeong-woo, economist at SK Securities.

Exports are expected to stage a recovery in the coming quarters, as the country’s key buyers, China and the U.S., are showing some signs of relief, Park said.

In the short term, however, the export front seems as beleaguered as ever. The trade account is estimated to have dipped to a loss of $2.9 billion from Jan. 1-20, according to Mirae Asset Securities.

“We cannot rule out the possibility that exports might drop in the first quarter as well,” said Park Hee-chan, analyst at Mirae Asset.

Analysts are divided on whether the Korean economy has already hit bottom. Some brokerages such as Shinhan Securities said it turned the corner in the fourth quarter of last year, while others claimed that the second quarter of this year would be the worst in the short-term cycle.

What’s certain is that the steep slowdown of GDP growth in the fourth quarter is more troubling evidence that the BOK must consider for its rate-setting decision.

The central bank kept the policy rate unchanged at 3.25 percent for a seventh straight month in January, even though inflation is overshooting its target band of 2-4 percent.

Gov. Kim Choong-soo recently reiterated the bank’s resolve to normalize the rate when certain conditions are met, but analysts said a rate cut might be needed sometime this year to help bolster the country’s embattled growth.

The Korean government plans to spend the bulk of its budget in the first half of this year to prop up the economy.

Korea’s economic growth slowed further at the end of 2011 amid deepening concerns about the impact of the eurozone fiscal crisis on exports.

The country’s gross domestic product rose 0.4 percent in the October-December period from the previous quarter, marking the lowest gain in two years, the Bank of Korea’s data showed Thursday.

GDP growth, the broadest measure of economic performance, steadily lost steam last year from 1.3 percent in the first quarter to 0.9 percent in the second and 0.8 percent in the third, according to the bank’s advance estimate.

The economy grew 3.4 percent in the final quarter from the same period a year earlier, slowing down from 3.5 percent year-on-year growth in the previous quarter. For all of 2011, the GDP expanded 3.6 percent, down from 6.2 percent growth in 2010 and slightly lower than the BOK’s earlier projection of 3.8 percent.

All three key indicators ― exports, consumption and investment ― were all in negative territory in the final quarter.

“The eurozone sovereign debt crisis seems to have hit Korea’s facility investment and consumption with a bigger impact that previously thought,” said Kim Young-bae, director general of the BOK’s economic statistics division, at a news briefing after the advance figures were released.

“The key in the first quarter of this year is how much the country can shield itself from the eurozone’s influence,” Kim said.

A closer look at the GDP data reveals an unsettling trend for Asia’s fourth-largest economy. Exports, which account for 50 percent of the country’s GDP, dropped 1.5 percent in the fourth quarter, swinging into the red for the first time in two years, hurt by deteriorating demand from abroad.

Imports fell at a faster rate of 3.1 percent from the previous quarter, as Korean companies cut import orders for capital goods in the face of greater external uncertainties.

Private consumption dropped 0.4 percent and facility investment plunged 5.2 percent during the cited period.

“Private consumption is expected to remain at a weaker level this year, as consumers struggle with higher housing costs, less disposable income due to rising oil prices and the sluggish financial market,” said Park Jeong-woo, economist at SK Securities.

Exports are expected to stage a recovery in the coming quarters, as the country’s key buyers, China and the U.S., are showing some signs of relief, Park said.

In the short term, however, the export front seems as beleaguered as ever. The trade account is estimated to have dipped to a loss of $2.9 billion from Jan. 1-20, according to Mirae Asset Securities.

“We cannot rule out the possibility that exports might drop in the first quarter as well,” said Park Hee-chan, analyst at Mirae Asset.

Analysts are divided on whether the Korean economy has already hit bottom. Some brokerages such as Shinhan Securities said it turned the corner in the fourth quarter of last year, while others claimed that the second quarter of this year would be the worst in the short-term cycle.

What’s certain is that the steep slowdown of GDP growth in the fourth quarter is more troubling evidence that the BOK must consider for its rate-setting decision.

The central bank kept the policy rate unchanged at 3.25 percent for a seventh straight month in January, even though inflation is overshooting its target band of 2-4 percent.

Gov. Kim Choong-soo recently reiterated the bank’s resolve to normalize the rate when certain conditions are met, but analysts said a rate cut might be needed sometime this year to help bolster the country’s embattled growth.

The Korean government plans to spend the bulk of its budget in the first half of this year to prop up the economy.

No comments:

Post a Comment